How to Form an LLC in California?

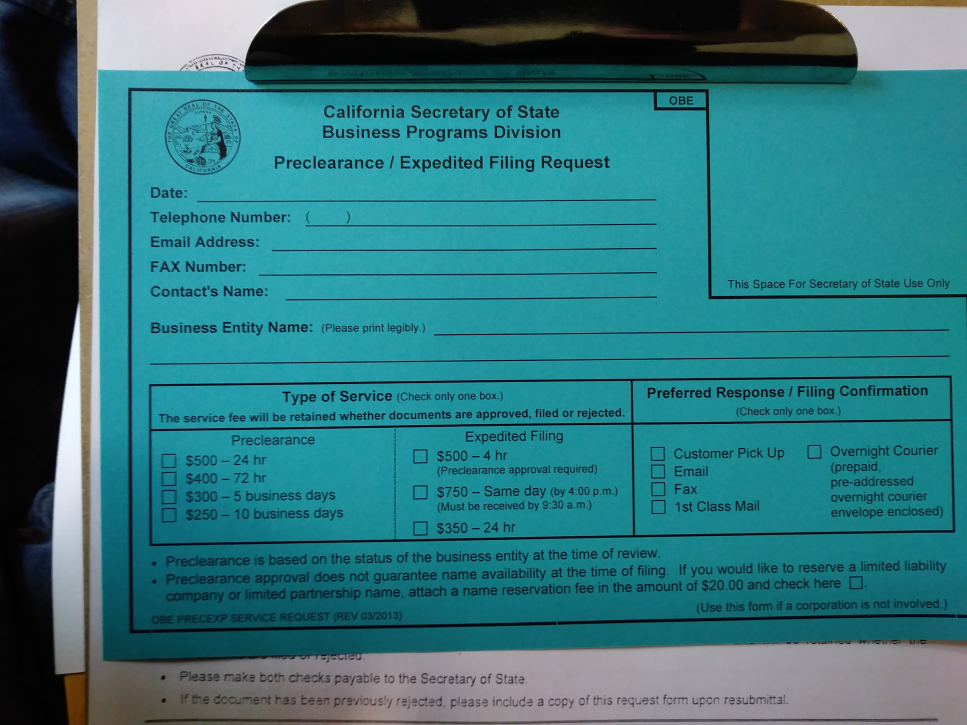

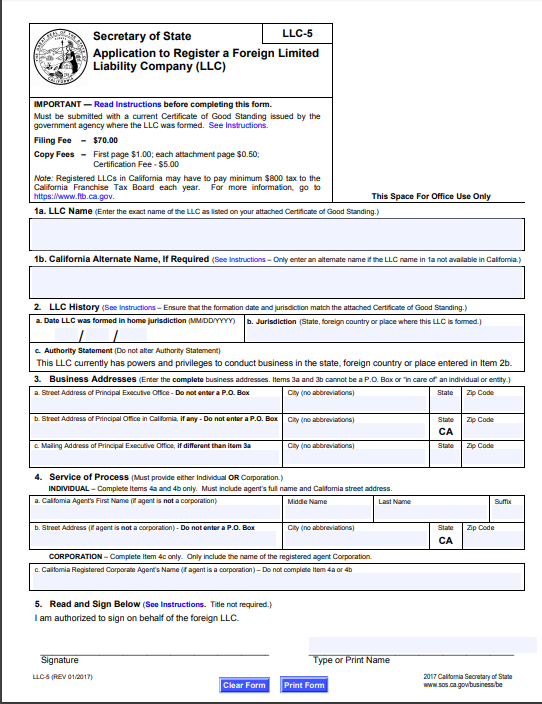

We provide expedited llc filing California, filing articles of incorporation in California, register a foreign corporation in California daily. The California Secretary of State office is located at 1500 11th St, Sacramento, CA 95814.

Order LLC Filing Service

Filing LLC California documents is an integral step in setting up a new organization and it’s important to do so with the assistance of a critically acclaimed company.

This all-in-one company offers a wide array of filing services ensuring LLC documents are managed, organized, and filed as required. Clients will gain access to a professional and committed team of specialists with years of expertise in filing LLC documentation.

When it comes to a well-established company in Sacramento, we offer the perfect solution for all clients!

How to Form an LLC in California

Setting Up an LLC

To set up a valid LLC (Limited Liability Company), the first step requires access to a certified filing company with accredited expertise. Once a professional company such as this one is hired, the initial LLC Operating Agreement has to be established. This enables the company to set up pre-determined policies, which can include potential structural decisions, operational determinations, and how everything will sync with mandatory Ca LLC filing regulations in Sacramento.

Start Your Company For Just $49 + State Filing Fees

A business is required to set up a fully functional management structure in relation to its specific needs. The purpose of doing this is to have legal backing in case the management structure is referred to in future legal proceedings.

A valid LLC Operating Agreement is going to include key information such as the company’s name, address, profit allocations, buy-out options, the purpose of your California expedited LLC filing, who will be making managerial decisions, and even the split between each member pertaining to the LLC itself. All important information is expected to be clearly detailed in this document. To ensure the document is properly filed, this company takes the time to list all relevant requirements well in advance including potential accounting needs, re-election procedures and any other required information key to running the company.

Please note, each situation is different and these details should be discussed between all voting parties before the LLC Operating Agreement is penned and filed.

Important forms may include:

* Limited Liability Company Worksheet

* Limited Partnership Agreement

* Single Member LLC Operating Agreement

* And More

We are more than happy to help with this process and will remain available for guidance.

LLC Dissolution Process

If the business has come to an end and requires immediate dissolution, we are the ideal company for all of your filing needs.

The LLC will have come along with state-based documentation, which is provided to both state and federal authorities including the Internal Revenue Service (IRS). In some cases, the state may also require additional filing for licensing authorities in the region. All of these documents will have to be updated based on the established dissolution claim. Remember, to these authorities, the business is active until it is legally ceased through the termination of your LLC Operating Agreement. If key dates are missed (i.e. taxation deadlines), this can have legal implications on the leading members on the agreement.

To assist with this process, we will take the time to help fill out appropriate documentation with regards to taxes, state fees, and/or all relevant reporting standards. Please note, this is the only way to ensure the business doesn’t have to deal with ongoing lawsuits with creditors down the road.

The LLC dissolution process also incorporates understanding state and taxing regulations in the area for terminated LLCs. All of this information is offered by the company and will ensure the appropriate documents are filed in a timely fashion. Once the documentation is filed, everything will go through the main state agency guaranteeing immediate termination.

The assets will be distributed based on the built-in LLC agreement and what was mentioned if dissolution were to occur (i.e. the distribution of assets).

Why We Are The Best

Professional

We are a professional company with years of experience in the management and filing of LLC Operating Agreements. We recognize the intricacies of filing in the Sacramento region and will be able to provide immediate guidance when the process begins. This is the best way to feel safe and on top of things from day one.

Fully Personalized Documentation

The LLC filing has to be done with accuracy, organization, and complete professional to ensure positive results. By choosing this company, you are going to get the opportunity to fully personalize the LLC Operating Agreement as soon as it is penned. Instead of waiting around, take the time to sign up with this company and file the right way.

Each document will be customized based on the client’s needs including relevant information involving accounting, structural needs, and buy-out options. This is integral to the company’s security and longevity as a legitimate operation.

Legal Filings

The filing of new LLC documents is an important legal process and has to be managed by the best in Sacramento.

This company is more than happy to offer assistance every step of the way during the filing of a new LLC setup. This will include which documents are required, how to fill them out, and what’s required to push the timeline along. Each step is essential to the establishment of a new company and can easily be done with our assistance.

Timely

Don’t want to waste time with the filing process and want it to move quickly?

All clients will receive immediate advice on what’s required and how to make sure the documents are filled accurately. This can save time and ensure everything is done based on your specific timeline.

The same applies to those filing for dissolution.

Hassle-Free Service

The hassle of filing in Sacramento can be frustrating and increasingly complex, which is why it is best to go with a certified filing company such as this one.

The task will be handled right away and is going to incorporate a hassle-free approach. This is the ideal solution for those who want to fill out all relevant information and have professionals handle the filing process.

Each step is listed in advance and will include your approval before the documents are sent in.

For more information on filing LLC documents in Sacramento, please take the time to call in and set up an appointment with one of our leading legal specialists.

How To Order LLC Filing in California?

Email your prepared LLC Documents and instructions to serviceofprocess916@gmail.com or fax to (916) 244-2636. Instructions should include type of service: Routine Business Filing Services, 24 hour Business Filing Services, Same Day Business Filing Services.